Buy Movo Cash Account

$30.00 – $145.00

If you are looking for Movo Accounts online, this is the place to be. MOVOCASH reports with mass-to-acquire functions should not be overlooked. You can buy movocash accounts here without any fees if you are looking for the best.

Acquire Movocash Accounts

- MOVO money is Run by a Greendot Financial Institution card.

- We offer a complete account with all legal details.

- You can create an unlimited digital card with the accounts.

- To get Bitcoin at a low cost, top-up MOVO income accounts can be used to earn Bitcoin.

- Get cash all over America by delivering.

- You will have U.S. banking accounts and VCC selections.

- Accessibility accounts allow you to make VCC from a willing cell program.

Recognize the immediate deposit and provide cover for Samsung, Apple, and other brands anytime.

Shipping and Shipping Supplies

- Private Information of Consumers

- Log in ID & Password

- Accessibility to phone-numbers

Prerequisites and Obligations

- To avoid suspension, you should make contact with a new USA IP address.

- Pre-activated accounts. To activate your account, you will need to pay a minimum.

ABOUT MOVO AND ACQUIRE MOVO ACCOUNTS

Movo accounts This is a new way to bill, create duties, and send/receive money, regardless of credit score or background. Greendot is an FDIC-insured USA bank service provider. Their service will allow you to have your U S A bank account and a replacement to generate a digital visa card. This service was available in all 50 states.

Change Your Mobile Into a Banking & Banking Device.

Forget about some lenders. Today’s world and duties, as well as banking, are mobile. MOVO is changing the way you can use payment and banking services. The MOVO software (TM), is available to all consumers regardless of credit score. Don’t delay getting move cash accounts.

- Send money and get it instantly and for free

- Create a CASH card (virtual card) to get instant cash access and invest

- Pay your bills quickly and easily while on the move.

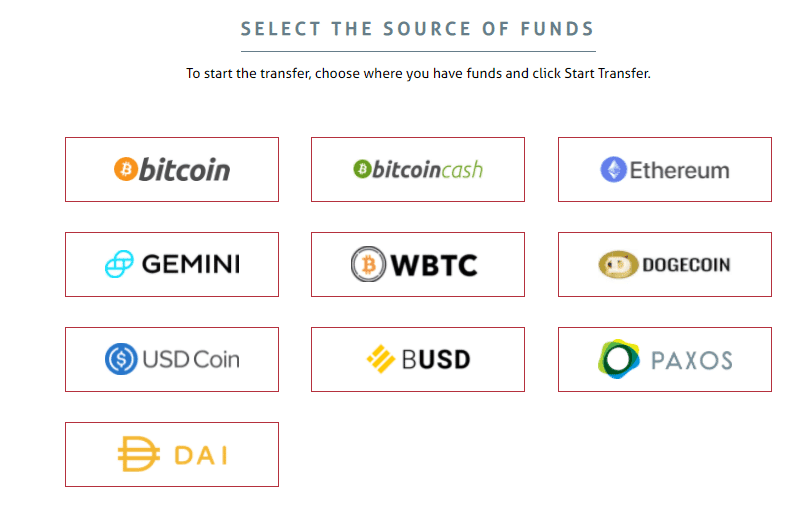

- You can load funds for free by opening a bank account, or directly using P2P services such as PayPal, Square Cash, and Google Wallet.

- Direct deposit is a fast way to get your paycheck. You can also load cash at thousands of retail locations such as wall mart and 7-Eleven, Safeway, and Vons.

- You can manage your balance, deposit, and trades from one convenient location.

We aim to create effective methods for starting with your money in an environment that is more portable.

WHAT’S UP WITH THE BITCOIN STUFF?!

Then there is cryptocurrency. Movo is a single movo prepaid credit card that allows you to use bitcoin or bitcoin cash to transfer funds or buy bitcoin movo. It’s an interesting feature, but it raises questions about who would use it. My personal interest in cryptocurrency is low, I will admit. I may be speaking out of my blockchain by stating that Movo’s bitcoin feature is more of a novelty than a key feature.

More Accounts: Buy Moneylion Bank Account

It is charged a fee for anyone who intends to use it. Transfers are charged at 2% of the transfer amount and a $2 level fee.

MOVO PERSONALLY, CAN I USE IT AS A ORGANIZATION ACCOUNT?

MOVO is intended for use and should not be considered a business account. The accounts are subject to specific rules and regulations. MOVO is currently exploring business accounts as a potential product offering. Keep learning!

What is the maximum amount I could pay for an employer’s movo cash balance?

There is a maximum amount that you cannot exceed. For more information, please refer to the MOVO terms & requirements.

Loading funds: Earning money at the bank to your MOVO Accounts ™. It is difficult!

TO LOAD MONEY FROM A BANK ACCOUNT TO MOVO

- Log in to your account on the lender’s website.

- If you have not yet connected MOVO(r), you will need to do so.

- Follow the instructions of your bank to transfer funds (Immediate deposit or ACH) into your MOVO Account™.

These ACH financial transfers take on average 2 to 3 business days to complete. All capital funds are posted to your MOVO CASH TM before you notice the withdrawal.

Can my Currency FDIC Insure Me?

Yes! Yes! All funds in Your MOVOCASH(TM), are kept at Metropolitan Business Bank. FDIC insurance will cover your MOVO account(TM) up to $250,000. You can easily order Movocash accounts if you are serious about buying them. Buy Movocash accounts as many times as you like.

END OF LINE

Movocash accounts can be purchased if you are crazy about bitcoin. The movo is a great-prepaid card. Movo’s is a good choice even if you aren’t a movo virtual visa cardholder. Despite the fact that it requires no ATM withdrawals or savings, it has budgeting and saving features.

This card can be used for very little if you are able to stop using ATMs and find other ways to save money. This card is best for Bitcoin enthusiasts or anyone who wants to save money on month-to-month movo Visa Card fees.

| Price | Movo Cash Account, Movo Verified Account with Documents |

|---|

6 reviews for Buy Movo Cash Account

4.67

/5Based on 6 rating(s)

5 Star

4 Star

3 Star

2 Star

1 Star

Reviewed by 01 customer(s)

-

Julian

Amazing professionals. Really happy with the service from them.

February 19, 2023Verified Review -

Daniel

I am so satisfied with Full Verified & their customer support.

June 12, 2022Verified Review -

Julian

I can recommend your operation to others.

May 5, 2021Verified Review -

Kaden Arabic

I have just started an it’s amazing thank you

April 7, 2020Verified Review -

Riley

My experience with oldvcc has been amazing. I really appreciate their services.

December 29, 2019Verified Review -

Phoenix

Excellent quality was friendly and everything was great throughout the the time I was there.

June 28, 2018Verified Review

Related products

-

Bank Account

Buy Verified N26 Account

Rated 4.33 out of 5$350.00Original price was: $350.00.$320.00Current price is: $320.00. Add to cart -

Bank Account

Buy Moneylion Bank Account

Rated 4.20 out of 5$25.00Original price was: $25.00.$20.00Current price is: $20.00. Add to cart

Leave feedback about this